FAQ

Forex Hotline:(852) 3890 0668

Bright Smart Forex Hotline: (852) 3890 0668

| 1. | Trading Hours? |

|

|

Winter and Summer Time

|

| 2. | What is the minimum/maximum number of contracts in each trade? |

|

|

For each individual order,

|

| 3. | What is the contract amount for each product? | ||||||||||||||||

|

|

|

| 4. | What is the bid/ask spread? |

|

|

The bid/ask spread is as low as 1 point, which is the fourth decimal figure of the price (except for pairs featuring JPY in which 1 point is the second decimal figure).

|

| 5. | What is the tick size? | ||||||||||||||||

|

|

|

| 6. | How much is the trading commission? |

|

|

No commission is charged as clients perform trades directly in the market through internet and no manual cost is involved.

|

| 7. | What is the initial margin/maintenance margin level? | |||||||||||||||

|

|

|

| 8. | Will I receive margin call message by means other than e-mail? |

|

|

Our company will only send margin call message by e-mail.

|

| 9. | What are the accounts for fund deposit? | ||||||||||||||||||

|

|

Clients may select one of the following banks for depositing into our company by cheque made payable to“Bright Smart Forex Limited”:

|

| 10. | What is the overnight interest rate of leverage forex? | |||||||||

|

|

Daily interest:

|

| 11. | Is physical settlement available? |

|

|

There is no physical settlement for forex trading.

|

| 12. | On which exchange will the clearing take place? |

|

|

Leveraged forex trading takes place in over-the-counter markets so no exchange is involved.

|

| 13. | Can I transfer fund internally from my other accounts in Bright Smart to my leveraged forex account? |

|

|

Clients can transfer fund internally to the leverage forex account but they should notify our company 1 working day before for processing the transfer. Fund deposit shall become effective subject to the deposit time and amount shown on MT4.

|

| 14. | When can I withdraw after trading? Can I make withdrawal on T+0? |

|

|

Clients may make withdrawal immediately after trading. The daily cut-off time for withdrawal is 1:00pm on working days.

|

| 15. | Is the fund deposit/withdrawal procedure same with that for securities account? |

|

|

Electronic channel is not available for withdrawal request and deposit confirmation. Branch clients should call respective branch hotline while headquarter clients should call Bright Smart Forex Hotline 3890 0668.

|

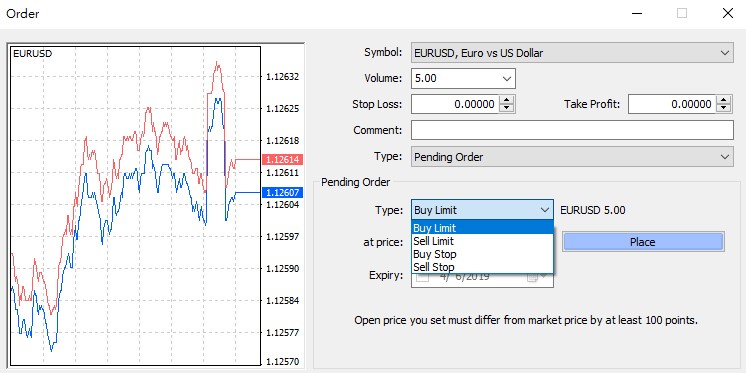

| 16. | Types of order : |

|

|

BUY LIMIT : Buy at a price lower than the market price |

| 17. | How can I check my trading history? |

|

|

In addition to statements, clients can check their trade history in the "Account History" page on the trading platform.

|

| 18. | Will the bid-ask spread varies when there are important data and news (e.g. non-farm payrolls, Fed interest rate decision) released to the market and the prices become volatile? |

|

|

Buy/sell prices may vary dramatically because of a volatile market and the bid-ask spread may also become greater than normal.

|

| 19. | How to register a demo account? Is it self-service? |

|

|

Clients may download MT4 trading platform on our company website.

|

| 20. | Can I place order via telephone? |

|

|

Clients may place order by calling Bright Smart Forex Hotline (for position-closing only). Commission fee of HKD$300 or USD$40 will be charge for trading of each board lot (rounded up to the next board lot) via telephone.

|

| 21. | If I deposit and confirm deposit immediately after receiving the call margin message from system, will the position be force-liquidated by system as BS Bullion requires processing time for deposit confirmation? |

|

|

The above situation could happen as the deposit is not effective until it is officially shown in the system. Clients should pay attention to the margin level of their account and maintain the level at a reasonable and secure level to avoid force-liquidation due to insufficient margin and any loss incurred.

|

| 22. | Is there maximum rise and drop in price, or maximum up/down %? |

|

|

No, the rise and drop is determined by the market.

|

| 23. | Is there any mobile platform for order placing? |

|

|

Yes, our company provides MetaTrader4 (MT4)手機交易平台 to our clients.

|

| 24. | Is any there restriction for order placing? |

|

|

Yes, the order price should be at least 10 points away from the current market price (i.e. 100 Points in MT4 system).

|

| 25. | Is there any account opening fee and minimum deposit in the account? |

|

|

There is no account opening fee and minimum deposit but clients are required to deposit funds to meet the initial margin requirement of opening a position before they can begin trading.

|

| 26. | Which currencies are used for trading? |

|

|

We offer HKD settlement account (RATE: 1 USD : 7.849 HKD) and USD settlement account. (*7.849 is the reference rate of USD/HKD. The actual exchange rate varies from time to time, and is subject to the exchange rate on MT4.)

|

| 27. | Is there any handling fee for deposit and withdrawal? |

|

|

We do not charge any handling fee for deposit and withdrawal but clients shall bear all bank charges.

|

| 28. | Will there be any interest incurred if I do not perform any trade? |

|

|

Clients are not required to pay any interest if they do not hold any position when the market closes.

|

| 29. | What is the leverage ratio? |

|

|

The leverage ratio is 1:20.

|

| 30. | What are the trading arrangements on holidays? |

|

|

Holidays and trading hours will be posted to Leverage Forex Announcement Board on the Company website.

|

Forex Hotline (852) 3890 0668