HK Stocks

Introduction

The benchmark Hang Seng Index is composed of 80 constituent stocks, the index includes the largest and most liquid stocks listed in Hong Kong. The constituent stocks are grouped under different sectors such as Finance, Telecommunications, Properties, Utilities and so forth. Apart from stocks of listed enterprises, there are also different kinds of securities available for trading such as warrants, Callable Bull/Bear Contracts (CBBC), Exchange-traded Funds (ETFs) and Real Estate Investment Trusts (REITs).

Hong Kong Stock Trading Hours

| Time | Period |

|---|---|

| 09:00am-09:30am | Pre Market Opening Period |

| 09:30am-12:00pm | Morning Trading Session |

| 12:00pm-01:00pm | Lunch Closing |

| 01:00pm-04:00pm | Afternoon Trading Session |

| 04:00pm-04:10pm | Closing Auction Trading Session |

All stock trades in Hong Kong are settled on the second trading day after transaction date (T+2). Comparing with the stock markets in different neighbouring regions, Hong Kong has less trade restrictions as investors can immediately sell the stocks purchased earlier on the same trading day.

Warrants / Covered Warrants

Apart from listed company stocks, trading of certain derivative products such as warrants, covered warrants and CBBCs is also hugely popular.

Warrant is a right but not an obligation to buy or sell a certain underlying assets (stock, index, currency or commodity) at a pre-determined price (strike price) on or before a pre-determined date (Expiry Date).

Companies issue call warrants over its own stock to raise capital for themselves. When the warrants are exercised, the company will issue new shares for settlement. Some company warrants are American warrants, which allow investors to exercise the warrants on or before the expiry date.

| Covered call warrant: | On the expiry date of the call warrant, holders can buy the asset from the issuer based on the conversion ratio at the strike price. It fits the needs of investors who are optimistic about the movement in asset price. |

| Covered put warrant: | On the expiry date of the put warrant, holders can sell the asset to the issuer based on the conversion ratio at the strike price. It fits the needs of investors who are pessimistic about the movement in asset price. |

3. About Cash Settlement

All warrants in Hong Kong are European cash settled (i.e. exercised on maturity date and settled in the form of cash). Settlement price of stock warrants is determined using the 5-day average closing price of the underlying stock. If the warrant expires in the money at maturity, the cash settlement amount will be automatically transferred to the client account while transaction costs such as handling fees would apply.

4. What is a CBBC ?

Callable Bull/Bear Contracts (CBBC) is a derivative product with terms similar to warrants such as strike price, expiry date and conversion ratios.

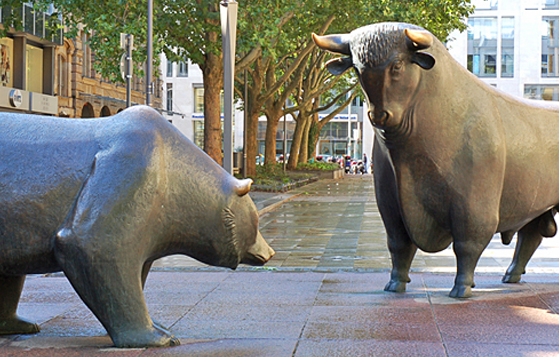

There are 2 types of CBBCs: Bull contract and Bear contract. The bull contract represents optimistic and the Bear contract represents pessimistic on a particular underlying. Investor can enjoy the gearing effect of changes in underlying price through a small amount of investment.

However, investors should also pay attention to the call price, as the CBBC will be called and its trading will be terminated once the index/stock price reaches the call price, regardless of the strike price and the expiry date.