FAQ

Bullion Hotline:(852) 3890 0668

| 1. | Trading hours? | ||||||||||||||||||

|

Summer Time: (HK hours) Monday 7:00 a.m till Saturday 5:00 a.m |

|||||||||||||||||||

| 2. | What is the minimum/maximum trade quantity per trade? | ||||||||||||||||||

|

Gold: 0.1 Lot (min.), 3 Lots (max.) per trade |

|||||||||||||||||||

| 3. | What is the contract unit per lot? | ||||||||||||||||||

|

Gold: 100 Ounces per lot |

|||||||||||||||||||

| 4. | What is the buy/sell spread? | ||||||||||||||||||

|

We provide the best quoted price from a number of international investment banks. The buy/sell spread of gold is as low as USD 20 cents. |

|||||||||||||||||||

| 5. | What is the tick size? | ||||||||||||||||||

|

Gold: 0.01 USD (1 point), Silver: 0.0010 USD (10 points) |

|||||||||||||||||||

| 6. | How much is the trading commission? | ||||||||||||||||||

|

There is no commission required as clients trade directly in the market via internet. |

|||||||||||||||||||

| 7. |

How much is the initial deposit/ maintenance deposit? |

||||||||||||||||||

|

Initial deposit |

|||||||||||||||||||

| 8. | Is there any contact methods other than email for calling margin? | ||||||||||||||||||

| We contact our clients by email only. | |||||||||||||||||||

| 9. | Which bank accounts should I make deposit to? | ||||||||||||||||||

|

Clients trading "Precious Metal" can make deposit into our company through one of the banks below:

Made payable to: Bright Smart Global Bullion Ltd. |

|||||||||||||||||||

| 10. | What are the overnight rate for London Gold/ Silver? | ||||||||||||||||||

|

We are now offering our clients an overnight interest waiver for precious metal trading. Normally brokers charge overnight interest at 1% to 2.75% per annum. For instance, a client who holds a spot gold contract (100oz gold, priced at USD1,250.00) overnight, brokers would charge an overnight interest up to USD10.00. |

|||||||||||||||||||

| 11. | Why does Bright Smart provide a quotation different from other brokers? | ||||||||||||||||||

|

The quotations for precious metals by Bright Smart are collected from multiple international investment banks. We will select the best quotation price for our customers and the process is fair, open and transparent. Orders from clients will be sent directly to the market. In contrast, other brokers would perform proprietary trading to bet against their customers so basically they have an opposite position to customers'. In those brokers, orders from clients will not be sent directly to the market but taken up by the company themselves that the broker will use customers' position for betting. As a result, the broker and its customers stand on opposite sides in terms of gain and loss. Also, customers may have to undertake the bankrupt risk of the company. |

|||||||||||||||||||

| 12. | Can the contract be settled by physical delivery? | ||||||||||||||||||

|

No. |

|||||||||||||||||||

| 13. | Which exchange will be used for settlement purpose? | ||||||||||||||||||

|

Precious metals trading is organized on an over-the-counter basis, which does not involve any exchange. |

|||||||||||||||||||

| 14. | Can I perform internal transfer from other BS accounts to my bullion account? | ||||||||||||||||||

|

Clients can perform internal transfer from other BS accounts to their bullion account if they inform us to arrange the transfer procedures 1 working day before the day of transfer. Deposit is subjected to the deposit time on MT4 and the deposit amount. |

|||||||||||||||||||

| 15. | When can I withdraw money after trading? Is it available on T+0 basis? | ||||||||||||||||||

|

Clients can withdraw money instantly. Please be reminded that the cut-off time for withdrawal of the Company is 1 pm on each working day. |

|||||||||||||||||||

| 16. | Is the procedure of deposit/withdrawl same as that of security account? | ||||||||||||||||||

|

We do not provide electronic service for withdrawl and deposit confirmation. Branch clients can contact the branch staff and headquarter clients can call the BS Bullion hotline. |

|||||||||||||||||||

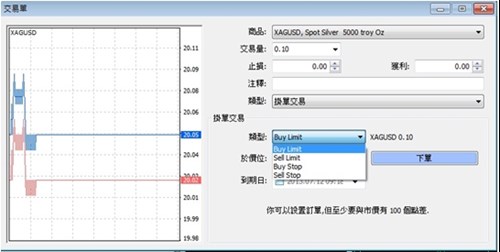

| 17. | Types of order: | ||||||||||||||||||

|

BUY LIMIT : Buy at price lower than the market price

|

|||||||||||||||||||

| 18. | How can I check the trade history of the account? | ||||||||||||||||||

|

In addition to statements, clients can check their trade history in the "account history" page on the trading platform. |

|||||||||||||||||||

| 19. | Will the bid-ask spread varies when there are important data and news (e.g. non-farm payrolls, Fed interest rate decision) released to the market and the prices become volatile? | ||||||||||||||||||

|

Buy/sell prices may vary dramatically because of a volatile market and the bid-ask spread may also become greater than normal. |

|||||||||||||||||||

| 20. | How to register a demo account? Is it self-service? | ||||||||||||||||||

|

Clients can download MT4 trading platform on our company website Trading platform > Documents> Open new demo account (self-registration) Effective duration for demo account : 2 weeks |

|||||||||||||||||||

| 21. | Can I place order by phone? | ||||||||||||||||||

|

Clients can place order by calling our BS Bullion hotline (for closing positions only). Additional handling fee of HK$300 or USD$40 per lot will be charged for phone ordering. Orders with quantity less than a round lot will also be treated as a round lot. |

|||||||||||||||||||

| 22. | If I deposit and confirm deposit immediately after receiving the call margin message from system, will the position be force-liquidated by system as BS Bullion requires processing time for deposit confirmation? | ||||||||||||||||||

|

The above situation could happen as the deposit is not effective until it is officially shown in the system. Clients should pay attention to the margin level of their account and maintain the level at a reasonable and secure level to avoid force-liquidation due to insufficient margin and any loss incurred. |

|||||||||||||||||||

| 23. | Is there maximum rise and drop in price, or maximum up/down %? | ||||||||||||||||||

|

No, the rise and drop is determined by the market. |

|||||||||||||||||||

| 24. | Can I place order on mobile platforms? | ||||||||||||||||||

| Yes, please refer to User Guide of Mobile Platform for more information. | |||||||||||||||||||

| 25. | Is there any limitation on orders? | ||||||||||||||||||

| Yes. Gold: order price must be within ±1USD (100 points) range from the current price; Silver: order price must be within ±0.03USD (300 points) range from the current price. | |||||||||||||||||||

| 26. | Is there any account opening fee and minimum balance required? | ||||||||||||||||||

| No account opening fee is charge and no minimum balance is required. However, clients can trade only when they have sufficient margin in their account. | |||||||||||||||||||

| 27. | Which currencies are used for trading? | ||||||||||||||||||

| We offer HKD settlement account (RATE: 1 USD :7.777 HKD) and USD settlement account. | |||||||||||||||||||

| 28. | Is there any handling fee for deposit and withdrawal? | ||||||||||||||||||

| We do not charge any handling fee for deposit and withdrawal but clients are responsible for any bank charges. | |||||||||||||||||||

| 29. | Will there be any interest incurred if I do not perform any trade? | ||||||||||||||||||

| Customers are not required to pay any interest if they do not hold any position when the market closes. | |||||||||||||||||||

| 30. | Leverage ratio? | ||||||||||||||||||

|

|||||||||||||||||||

| 31. | Holiday trading arrangement? | ||||||||||||||||||

| Holidays and trading hours will be posted to Bullion Announcement Board on the Company website. | |||||||||||||||||||

Bullion Hotline: