Shanghai / Shenzhen A Shares

Shanghai / Shenzhen Connect

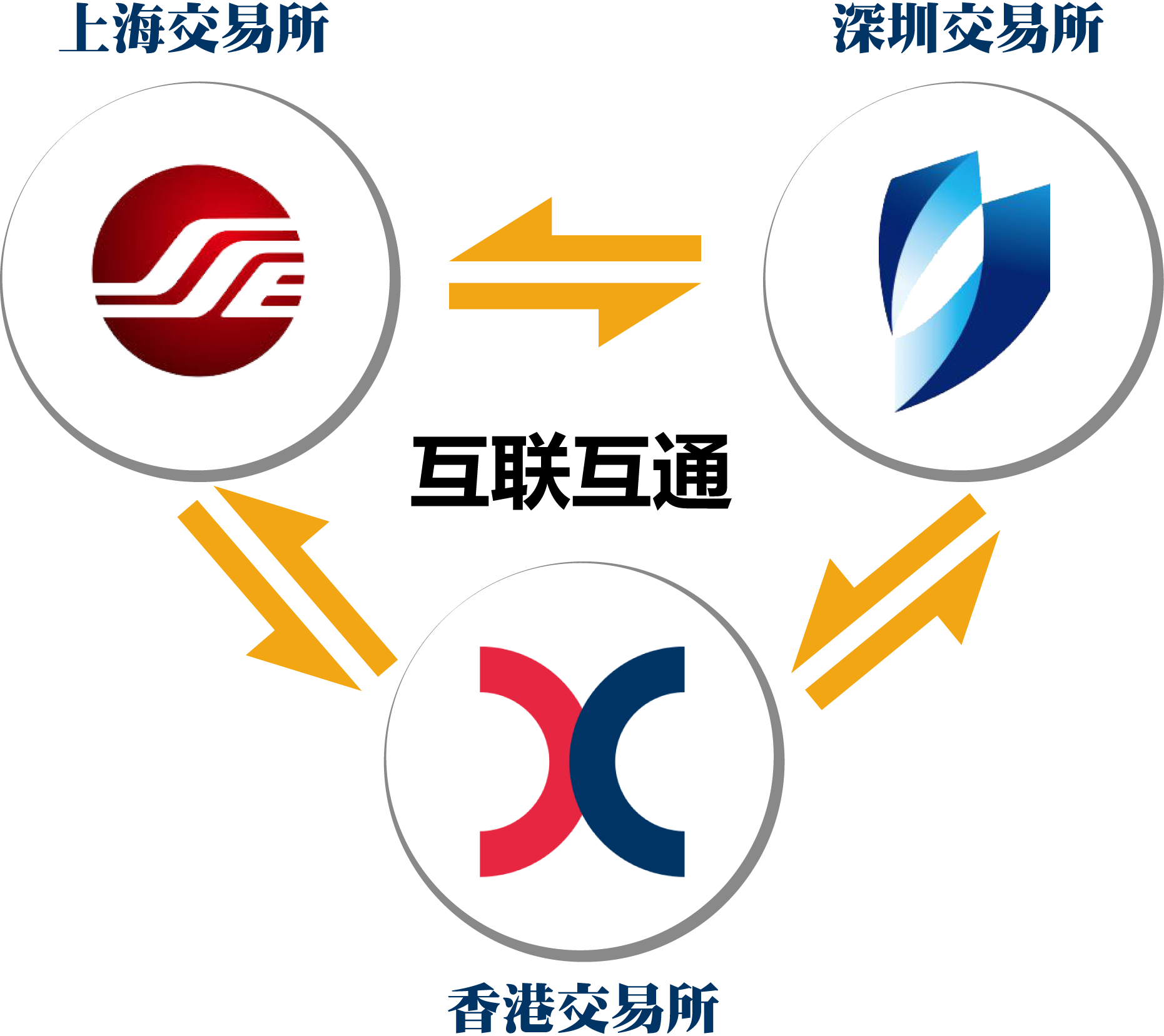

On 10 April 2014, the Securities and Futures Commission (SFC) and China Securities Regulatory Commission (CSRC) made a joint announcement regarding the in-principle approval for the development of Shanghai Connect for the establishment of mutual stock market access between Mainland China and Hong Kong. Under Shanghai Connect, The Stock Exchange of Hong Kong Limited (SEHK), a wholly-owned subsidiary of Hong Kong Exchanges and Clearing Limited (HKEX), and Shanghai Stock Exchange (SSE) established mutual order-routing connectivity and related technical infrastructure (Trading Links) to enable investors of their respective market to trade shares listed on the other’s market.

Hong Kong Securities Clearing Company Limited (HKSCC), also a wholly owned subsidiary of HKEX, and China Securities Depository and Clearing Corporation Limited (ChinaClear) have established clearing, settlement and nominee arrangements (Clearing Links) to provide for the clearing and settlement of trades executed through the Trading Links and the provision of depository, nominee and other related services to investors in the Mainland and Hong Kong.

Shanghai Connect created for the first time a feasible, controllable and expandable channel for mutual market access between the Mainland and Hong Kong by a broad range of investors, paving the way for further opening up of China’s capital account and RMB internationalisation.

Following the successful launch of Shanghai Connect on 17 November 2014, Shenzhen Connect is believed to be its natural extension, and launched on 5 December 2016 by and large applying similar programme principles and design.

In addition to shares of listed companies, Exchange Traded Funds (“ETFs”) are included as eligible securities to be traded under Shanghai Connect and Shenzhen Connect on 4 July 2022.

Investor and Participant Eligibility

Except ChiNext Stocks of Shenzhen Stock Exchange (SZSE) and STAR stocks of Shanghai Stock Exchange (SSE) which may only be traded by institutional professional investors, Hong Kong and overseas investors are allowed to trade any Connect Securities through Shanghai and Shenzhen Connect.

Shanghai and Shenzhen Connect is open to all SEHK Participants, SSE Members, SZSE Members, CCASS Participants, and ChinaClear Participants, subject to their meeting certain information technology capability, risk management and other requirements as may be specified by the relevant exchange and / or clearing house. The names of all eligible SEHK Participants and CCASS Participants have been published on the HKEX website.

Trading Arrangement Overview

To facilitate Hong Kong and overseas investors trading in SSE Securities through Shanghai Connect (i.e. Northbound trading), SEHK has established an SEHK Subsidiary in Shanghai, whose principal function is to receive orders to trade in SSE Securities from SEHK Participants and route them onto SSE’s trading platform for matching and execution on SSE. Upon trade execution, trade confirmation received from SSE will be sent to SEHK Partcipants.

For Shenzhen Connect, SEHK has established another SEHK Subsidiary in Qianhai Shenzhen, whose principal function is to receive orders to trade in SZSE Securities from SEHK Participants and route them onto SZSE’s trading platform for matching and execution on SZSE. Same as the current arrangement for trading Hong Kong stocks, investors who want to participate in Shanghai and Shenzhen Connect will trade through SEHK Participants. Investors should check with their SEHK Participants on any specific conditions that their SEHK Participants may require them to satisfy before accepting their Northbound orders. Northbound trades are executed on the SSE/SZSE platform, and therefore follow the SSE/SZSE market practices in general. The following part explains the market practices that are applicable to Northbound and Southbound under Shanghai and Shenzhen Connect.

It is contemplated that SEHK, SSE and SZSE would reserve the right to suspend Shanghai Connect and/or Shenzhen Connect respectively if necessary for ensuring an orderly and fair market and that risks are managed prudently. Suspension may be executed for a specific stock or all stocks of the relevant market(s). Consent from the relevant regulator would be sought before a suspension is triggered.

Trading Quota

Trading under Shanghai and Shenzhen Connect will be subject to a Daily Quota. There is no Aggregate Quota for Shanghai and Shenzhen Connect as the Aggregate Quota for Shanghai Connect was abolished since 16 August 2016. Northbound trading and Southbound trading are respectively subject to a separate set of Daily Quota, which is monitored by SEHK, SSE and SZSE respectively.

The Daily Quota is applied on a “net buy” basis. Based on that principle, investors are always allowed to sell their cross-boundary securities regardless of the quota balance. The Northbound Daily Quota balance is disseminated on the HKEX website at 1-minute intervals.

Daily Quota

The Daily Quota limits the maximum net buy value of cross-boundary trades under each of Shanghai and Shenzhen Connect each day. The Northbound Daily Quota is set at RMB 13 billion for each of Shanghai Connect and Shenzhen Connect, and the Southbound Daily Quota is set at RMB 10.5 billion for each of Shanghai Connect and Shenzhen Connect.

SEHK monitors the usage of the Northbound Daily Quota on a real time basis, and the Northbound Daily Quota Balance for each market is and will be updated on the HKEX website every minute:

Daily Quota Balance = Daily Quota – Buy Orders + Sell Trades + Adjustments

The Daily Quota will be reset every day. Unused Daily Quota will NOT be carried over to next day’s Daily Quota.

If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. However, as order cancellation is common during opening call auction, the Northbound Daily Quota Balance may resume to a positive level before the end of the opening call auction. When that happens, SEHK will again accept Northbound buy orders.

Once the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during a continuous auction session, no further buy orders will be accepted for the remainder of the day. The same arrangement applies to the closing call auction of SZSE. It should be noted that buy orders already accepted will not be affected by the Daily Quota being used up and will remain on the order book of SSE and SZSE respectively unless otherwise cancelled by relevant SEHK Participants.

Eligible Stocks

Under Shanghai Connect and Shenzhen Connect, SSE Securities that are eligible for trading by Hong Kong and overseas investors include all the constituent stocks of the SSE 180 Index and the SSE 380 Index, and all the SSE-listed A shares which have corresponding H shares listed on SEHK.

SZSE Securities that are eligible for trading by Hong Kong and overseas investors include all the constituent stocks of the SZSE Component Index and the SZSE Small/Mid Cap Innovation Index which have a market capitalization of not less than RMB 6 billion, and all the SZSE-listed A shares which have corresponding H shares listed on SEHK. The full list of Eligible Stocks is published on the HKEx website (Eligible Stocks) (SSE and SZSE stock codes are both 6-digits).

The full list of Eligible Stocks is published on the HKEx website (Eligible Stocks) (SSE and SZSE stock codes are both 6-digits).

Trading Order

1 Only Limit Order is accepted. Limit Order refers to trading order made throughout the day irrespective of the trading session.

2 Order amendment is not accepted. In the event that investor wishes to amend a placed order, he must first cancel the unexecuted order, and upon successful cancellation, to place a new trading order.

| SSE Trading Session | SSE Trading Hours | Time for SEHK Participants to input Northbound orders |

| Opening Call Auction | 09:15 – 09:25 | 09:10 – 11:30 |

| Continuous Auction(Morning) | 09:30 – 11:30 | |

| Continuous Auction(Afternoon) | 13:00 – 14:57 (For A Shares) 13:00 – 15:00 (For ETFs) |

12:55 – 15:00 |

| Closing Call Auction | 14:57 – 15:00 (Only for A shares) |

09:20 – 09:25 SSE will not accept order cancellation (for A shares and ETFs);

14:57 – 15:00: SSE will not accept order cancellation (for A shares).

09:10 – 09:15; 09:25 – 09:30; 12:55 – 13:00: Orders and order cancellations can be accepted by SEHK but will not be processed by SSE until SSE’s market open

Orders that are not executed during the opening call auction session will automatically enter the continuous auction session. Any buy or sell orders not executed during the continuous auction session will automatically enter the closing call auction session.

| SZSE Trading Session | SZSE Trading Hours | Time for SEHK Participants to input Northbound orders |

| Opening Call Auction | 09:15 – 09:25 | 09:10 – 11:30 |

| Continuous Auction(Morning) | 09:30 – 11:30 | |

| Continuous Auction(Afternoon) | 13:00 – 14:57 | 12:55 – 15:00 |

| Closing Call Auction | 14:57 – 15:00 |

09:20 – 09:25, 14:57 – 15:00: SZSE will not accept order cancellation (for A shares and ETFs).

09:10 – 09:15; 09:25 – 09:30; 12:55 – 13:00: Orders and order cancellations can be accepted by SEHK but will not be processed by SZSE until SZSE’s market open

Any buy or sell orders not executed during the opening call auction session will automatically enter the continuous auction session. Any buy or sell orders not executed during the continuous auction session will automatically enter the closing call auction session.

Trading Calendar

Northbound trading will only be available on a common trading day for both markets and settlement services are provided on money settlement day.

| 22/12 | 23/12 | 24/12 | 25/12 | 26/12 | |

| Monday | Tuesday | Wednesday | Thursday | Friday | |

| Hong Kong | Trading Day | Trading Day | Half Trading Day | Holiday | Holiday |

| Shanghai and Shenzhen | Trading Day | Trading Day | Trading Day | Trading Day | Trading Day |

| Northbound Trading | Trading Day | Trading Day | Trading Day | Closed | Closed |

| Soundbound Trading | Trading Day | Trading Day | Half Trading Day | Closed | Closed |

| Securities Settlement Day | Monday | Tuesday | --- | --- | --- |

| Money Settlement Day | Tuesday | Wednesday | --- | --- | --- |

| Remarks | Money settlement day is also trading day of both markets, with settlement services available | Money settlement day is also trading day of both markets, with settlement services available | Thursday is a Hong Kong holiday, no settlement service will be provided. Trading services will be closed on Wednesday. | HK holiday, market closed. | HK holiday, market closed. |

Trading calendar for Shanghai and Shenzhen Connect (2026)

http://www.hkex.com.hk

1 Day-trade is not allowed.

2 The board lot of all stocks is 100 shares. Buy order must be in board lot size, while odd lot is only allowed in sell order.

3 Board lot buy/sell order and odd lot sell order are both matched on the same trading platform of SSE, and auction is subject to the same price. Thus, the final executed quantity of buy order may include odd lot.

Severe Weather Conditions

In the initial stage, the trading arrangement under severe weather conditions is as follows:

(a) For Northbound trading,

i If SSE or SZSE is suspended due to inclement weather, there will be no Northbound trading on the relevant market and Hong Kong investors and CCEPs will be informed by SEHK;

ii If typhoon signal number 8 or above and/or black rainstorm warning is issued in Hong Kong before the Hong Kong market opens, Northbound trading will not open. If the signal/warning is subsequently discontinued on the same day, arrangement for the resumption of Northbound trading will follow that for the SEHK market (detailed arrangement is available on the HKEX website at https://www.hkex.com.hk/Services/Trading-hours-and-Severe-Weather-Arrangements/Severe-Weather-Arrangements/Trading?sc_lang=en);

iii If typhoon no. 8 or above is issued in Hong Kong after the Hong Kong market opens but before SSE’s market and SZSE’s market opens (between 9:00 a.m. and 9:15 a.m.), Northbound trading will not open; and

iv If typhoon signal number 8 or above is issued in Hong Kong after SSE’s and SZSE’s market have opened, trading will continue for 15 minutes during which order put and cancellation will be allowed. After 15 minutes, only order cancellation is allowed until the close of SSE’s market or SZSE’s market.

Similar to the holiday arrangement, HKEX will further consider whether there is any alternative arrangement or enhancement that can be done and will engage the market as appropriate

(b) For Southbound trading arrangement, it will be announced by SSE/SZSE in due course. For details of the existing typhoon/rainstorm procedure for the Hong Kong market, please refer to the HKEX website: https://www.hkex.com.hk/Services/Trading-hours-and-Severe-Weather-Arrangements/Severe-Weather-Arrangements/Trading?sc_lang=en

Price Restriction

1. For SSE Main Board Securities, SSE-listed ETFs, SZSE Main Board, SZSE-listed ETFs and SZSE SME Board Securities, there is a price limit of ±10% (and ±5% for stocks under special treatment (i.e. ST and *ST stocks)) based on previous closing price

2. All orders input for SSE Securities and SZSE Securities must be at or within the price limit. Any order with a price beyond the price limit will be rejected by SSE or SZSE. The upper and lower price limit will remain the same intra-day.

3. The lower price limit of buy orders is 3% lower than the current bid price (In the absence of a current bid price, the latest bid price applies; if current bid price is absent, the previous closing price applies).

Trading Restriction

Day trading is not allowed for both Connect Markets. Therefore, Hong Kong and overseas investors buying SSE and SZSE Securities on T-day can only sell the shares on and after T+1.

Taxes and Fees Arrangement

Under Shanghai and Shenzhen Connect, Hong Kong and overseas investors will be subject to the following fees and levies imposed by SSE, SZSE, ChinaClear, HKSCC or the relevant Mainland authority when they trade and settle SSE Securities and SZSE Securities:

| Items | Rate (A Shares) | Rate (ETFs) | Charged by |

| Handling Fee | 0.00341% of the consideration of a transaction per side |

0.004% of the consideration of a transaction per side |

SSE / SZSE |

| Securities Management Fee | 0.002% of the consideration of a transaction per side |

Waived | CSRC |

|

Transfer Fee(ChinaClear)

|

0.002% of the consideration of a |

0.002% of the consideration of a |

ChinaClear Shanghai / ChinaClear Shenzhen HKSCC |

| Stamp Duty | 0.05% of the consideration of a transaction on the seller |

Wavied | SAT |

All the above fees and levies will be collected from CCASS Participants’ designated bank accounts at day-end of T day.

Investors should note that certain existing CCASS fees still apply, including stock settlement fee for settlement instructions and money settlement fee. HKSCC also imposes a Portfolio Fee on its CCASS Participants for providing depository and nominee services for their SSE Securities and SZSE Securities held in CCASS. The Portfolio Fee will be collected in HKD on a monthly basis based on a single portfolio of SSE Securities and SZSE Securities of each CCASS Participant. The relevant fee arrangement may change subject to SFC’s approval.

Besides, taxes imposed by the State Administration of Taxation (SAT), including stamp duty and dividend tax will also be applied to the Northbound trades and SSE Securities acquired through Shanghai Connect as well as SZSE Securities acquired through Shenzhen Connect. Any additional tax 44 imposed by the SAT, if applicable, will be subject to further clarification with the SAT.

* Note: Fees are rounded to the nearest cent.

Dividend tax will be withheld by issuers of Connect Securities and ChinaClear upon dividend payment.

Key Differences of Trading and Settlement Arrangement between Hong Kong Stocks and SSE/SZSE securities

|

Items |

Hong Kong Stocks |

SSE/SZSE Securities (Northbound trading) |

|

Trading quota |

N/A |

Daily Quota(RMB 13 billion) |

|

Amend/ Cancel order |

Allowed |

Order amendment is not allowed |

|

Stock code |

5 digits |

6 digits |

|

Trading currency |

HKD |

RMB |

|

Price spread |

Different securities have different price spread. For details please refer to HKEx's website |

Unified at RMB0.01 |

|

Day-Trade |

Allowed |

Not allowed. Shares bought on T day can only be sold on or after T+1 day |

|

Trading Fees |

Transaction Levy, Trading Fee and Stamp Duty |

Handling fee, Securities Management Fee, Transfer Fee and Stamp Duty |

|

Board lot |

Set by listed company |

Unified at 100 shares per lot |

|

Odd lot |

All odd lot orders can only be traded via "odd lot brokers" and executed at the odd lot market price; the executed price is usually lower than the prevailing board lot market. |

Board lot orders and odd lot orders are both matched on the same platform, and subject to the same share price. Thus, the final buy orders execution may involve odd lots. |

|

Trade before settlement |

Allowed |

Not allowed |

|

Settlement cycles |

Both securities and money are settled on T+2 basis |

Securities: settled on T day |

* Comparison Table of the Financial Terms between Mainland China and Hong Kong:

As the jargons used in mainland China and Hong Kong are not identical, HKEx compiled a glossary of frequently used jargons in mainland China and Hong for mainland investors to understand the market news in Hong Kong. Please refer to the following link for the glossary: http://www.hkex.com.hk/-/media/hkex-market/mutual-market/stock-connect/reference-materials/resources/glossary_simplified

The above information is abstract of HKEx Shanghai-Hong Kong/ Shenzhen-Hong Kong Stock Connect page which may be amended or changed according to implementation of the regime or relevant regulations, laws, agreements and preparation or edition of other documents. Please visit the following website for more details:

https://www.hkex.com.hk/Mutual-Market/Stock-Connect?sc_lang=en

BS Group endeavors to ensure accuracy and reliability of the information provided, but does not guarantee that they are absolutely correct and reliable. BS Group accepts no liability, whether in tort or contract or otherwise, for any loss or damage arising from any inaccuracy or omission or from any decision, action or non-action based on or in reliance upon the information contained in this website.